Liquidity Facility to the Construction Sector and Other Suppliers of the Government

Operating Instructions

| 24.07.2020 | Operating Instruction No. 35/03/023/0001/003 | Liquidity Facility to Contractors and Suppliers of the Government in the Construction |

| 03.07.2020 | Operating Instruction No. 35/03/023/0001/002 | Liquidity Facility to the Construction Sector Upon 'Letter of Acceptance of Payments of Outstanding Bills Due to Contractors' Issued by the Treasury on behalf of the Government |

| 18.06.2020 | Operating Instruction No. 35/03/023/0001/001 |

Liquidity Facility to the Construction Sector upon Promissory Notes/Guarantees Issued by the Government |

Other Relevant Information

- Treasury Operations Circular No: 01/2020 dated 29.06.2020 http://www.treasury.gov.lk/treasury-operations-department

- Loan Agreement - already issued to LCBs

- Pledge Agreement for Treasury Bills – already issued to LCBs

- Pledge Agreement for Treasury Bonds – already issued to LCBs

- Steps to AS 400 System to enter information on Credit Facility (Click here)

- Operational Manual for Central Integrated Market Monitor (CIMM) (Click here)

- Banking Act Directions No. 06 of 2020

https://www.cbsl.gov.lk/en/laws/directions-circulars-guidelines-for-banks

Frequently Asked Questions

| 1. |

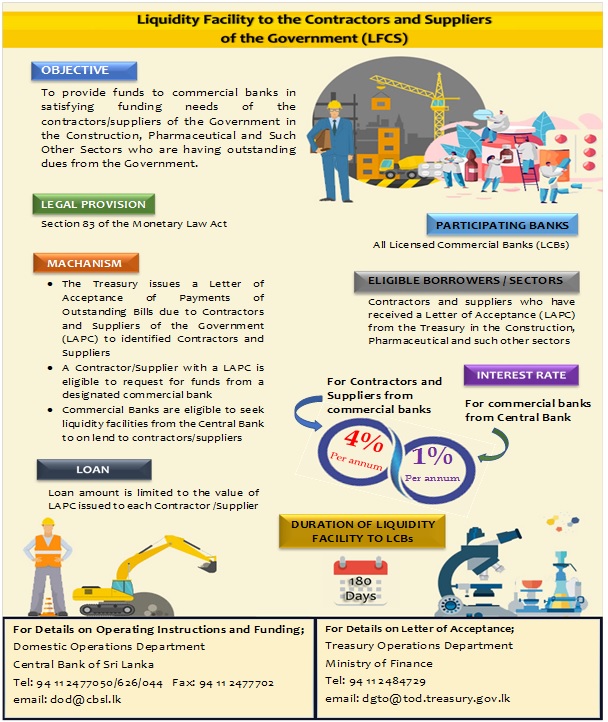

What is the purpose of this facility? The purpose of this liquidity facility is to enable licensed commercial banks (LCBs) to provide loan facilities to the Construction, Pharmaceutical Sectors and such other identified sectors, that was adversely affected by the COVID-19 outbreak against a “Letter of Acceptance of the Payment of Outstanding Bills (LAPC)”. |

| 2. |

Who is eligible to receive a “Letter of Acceptance of the Payment of Outstanding Bills (LAPC)” from the Government Treasury? Contractors and Suppliers of the Government in the Construction, Pharmaceutical Sectors and such other identified sectors, who are having outstanding dues from the Government of Sri Lanka. |

| 3. |

Who select the eligible borrowers? Relevant line ministries and Government departments. |

| 4. |

What is the procedure to select Contractors and Suppliers? Please refer to Treasury Operations Circular No. 01/2020 on “Economic Revival Assistance to Government Contractors/Suppliers in the Construction and other Sectors” issued by the Secretary to the Treasury on 29.06.2020 on the following web-link. |

| 5. |

Who issues the LAPC and to whom? Secretary to the Ministry of Finance, Economy and Policy Development issues the LAPC to the designated licensed commercial bank (LCB) as specified by the Contractor/Supplier with a copy to the Contractor/Supplier. |

| 6. |

Where can LAPC be collected from? From the relevant line ministry or the Government department. |

| 7. |

What is the Designated Bank Account? A bank account nominated by the Contractor/Supplier, of which the account details have been provided to the relevant line ministry or the Government department. |

| 8. |

In a scenario where an LCB had already funded a client for a project, can the client request for new funding against LAPC for the same project, without settling the current dues of the same project? The Treasury issues the LAPC to Contractors/Suppliers up to the value of outstanding dues from the Government, excluding dues already agreed for discounting by LCBs. A client with a LAPC is eligible to request for the liquidity facility, from the designated LCB and LCB is required to ensure that, total funds provided under this liquidity facility is exclusively utilized for on-lending to the sectors specified in the Operating Instructions. |

| 9. |

What is the maximum loan amount to be granted under LFCS per borrower? A client with a LAPC is eligible to request for the loan from the designated bank at an interest rate not exceeding 4% upto the amount specified in the LAPC. |

| 10. |

What is the interest rate, CBSL provide funds to LCBs under LFCS? CBSL provide funds to LCBs at an concessionary interest rate of 1% per annum. |

| 11. |

Will the rate of interest (1% per annum) at which the CBSL provide funds to LCBs under LFCS remain unchanged until the full recovery of the loans? 1% interest rate will remain unchanged upto 180 days. |

| 12. |

What is the maximum lending rate for Contractors/Suppliers under LFCS? Maximum interest rate is 4% per annum. |

| 13. |

What is the maximum repayment period of the borrower? LCBs may need to apply prudent lending standards, as LAPC confirms that the Treasury will provide necessary funds to settle the outstanding dues to the designated accounts of the banks on or before 31.12.2020. |

| 14. |

Can an LCB retain a margin against LAPC to secure interest of the loan? LCBs may need to apply prudent lending standards in this case. |

| 15. |

At what stage, should the LCB release the loan. Before receiving of funds from the CBSL or after receiving funds from the CBSL? LCBs may grant loans prudently and request for funds from CBSL as a liquidity support. Otherwise, LCB should ensure disbursement of the loan proceeds to eligible borrowers within one week from the date of receipt of the funds from the CBSL. |

| 16. |

How long will the CBSL take to release funds requested under LFCS? Central Bank will release funds to the Banks within one business day subject to fulfillment of requirements specified in Operating Instructions issued in this regard. If the requests are received before 1200 noon, the funds will be released on the same day. |

| 17. |

What is the repayment period for LCBs for the funds borrowed from the CBSL? As liquidity facility is for 180 days, the CBSL will deduct the principle amount of the loan plus the interest from the Current Account of the respective Bank in 180 days from the date of release of funds by the CBSL. |

| 18. |

Should the customer pay interest to the bank on a monthly basis? Banks may need to apply prudent lending standards in this case. |

| 19. |

Can the interest to the Bank for the 180 days calculated at 4% per annum be recovered upfront at the time of disbursement? Banks may do it with the concurrence of the borrower. |

| 20. |

What should an LCB do, in the case of an early settlement of dues to the Contractors/Suppliers by the Government? LCBs are required to immediately repay the CBSL, the total amount including the interest upto that date. |

| 21. |

What is the procedure to renew the financing from CBSL in the event of non-receipt of proceeds to the relevant LAPC after 180 days? LAPC confirms that the Treasury will provide necessary funds to settle the outstanding dues to the designated accounts of the banks on or before 31.12.2020. However, if the Government decides to issue fresh LAPCs to Contractors/Suppliers for unsettled amounts, immediate fresh funds will be made available at maturity of the facility upon submission of similar fresh promissory notes by the bank backed by pledged Treasury bills and Treasury bonds with the Central Bank. |

| 22. |

What are the securities that can be pledged to obtain funds under LFCS? LCBs can only pledge Treasury Bills and Treasury Bonds in their own holding as securities. |

| 23. |

What is the procedure for LCBs to pledge securities under LFCS? Securities should be pledged through the On-line Electronic Bidding System, similar to the procedure followed in pledging securities in Open Market Operations. |

| 24. |

What are the documents that need to be submitted to the CBSL to request for LFCS? LCBs are required to submit the following documents to the CBSL with the request for LFCS:

|

| 25. |

How to obtain the above documents? All documents and information required to be submitted by LCBs including operational manuals to generate Schedule III and contact information have been forwarded to CEOs of all Banks on 23.07.2020. |

| 26. |

Contact details to clarify doubts related to the LFCS 1. For further information from the Central Bank on LFCS, you may contact; 2. For further clarifications from the Department of Treasury Operations on LAPC, you may contact; |