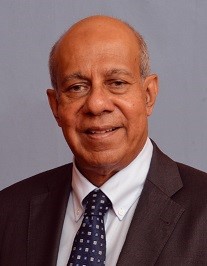

Mr. Anthony Nihal Fonseka was reappointed as a member of the Monetary Board of the Central Bank of Sri Lanka (CBSL) with effect from 26 May 2022. Previously, he served on the Monetary Board from July, 2016 to May 2020.

Mr. Anthony Nihal Fonseka was reappointed as a member of the Monetary Board of the Central Bank of Sri Lanka (CBSL) with effect from 26 May 2022. Previously, he served on the Monetary Board from July, 2016 to May 2020.

He obtained his BSc Degree from the University of Ceylon, Colombo and is a Fellow of the Chartered Institute of Bankers, UK and a Honorary Fellow of the Chartered Institute of Securities and Investments, UK. He is a Senior Independent Director and Chairman of the Group Audit Committee of John Keells Holdings PLC, Chairman of Phoenix Industries Ltd., Non-Executive Director and Chairman of the Audit Committee of Brandix Lanka Ltd. and a Non-Executive Director and Chairman of Investment Committee of Phoenix Ventures Ltd.