Crisis Communication

Debt Restructuring Process of the Government

What is Government Debt?

Government debt is also known as public debt and is often used interchangeably.

Government debt is also known as public debt and is often used interchangeably.

IMF “Public Sector Debt Statistics: Guide for Compilers and Users” defines;

- “Total debt” as “all liabilities that are debt instruments”.

- “A debt instrument” is defined as “a financial claim that requires payment(s) of interest and/or principal by the debtor to the creditor at a date, or dates, in the future.”

The following instruments are recognised as debt instruments:

- Special drawing rights (SDRs)

- Currency and deposits

- Debt securities

- Loans

- Insurance, pension, and standardized guarantee schemes and

- Other accounts payable

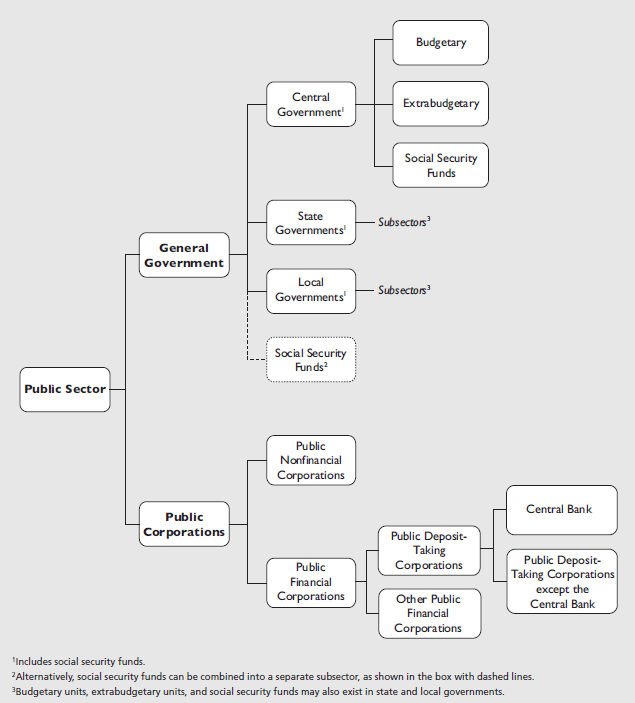

The exact meaning or the definition of the “Public Debt” or the “Government Debt” depends on the context the term “debt” is being used. Figure 1 shows the classification of the public sector and its components as per the IMF Government Finance Statistics (GFS) Manual 2014.

Currently the debt raised by the Central Bank of Sri Lanka (CBSL) falls under the category of “Budgetary Central Government Debt”. However, in the case if CBSL has to raise debt on behalf of other sectors of the Government, a broader definition of debt might be applied based on the context.

Classification of Public Sector

What is Debt Restructuring?

The Debt Restructuring is the process undertaken to re-establish debt sustainability and the decision to restructure is undertaken when no other option to re-gain debt sustainability is considered politically or socially acceptable. The Debt Restructuring aims at manageable levels of Gross Financing Needs (GFNs), manageable levels of debt services denominated in domestic and foreign currency and a declining Debt to Gross Domestic Product (GDP) ratio to manageable levels in the medium-to-long run.

How do you reduce / restructure debt?

Accordingly, once the decision of debt restructuring is made the debtor is required to indicate on which claims should be included, i.e., subject to the restructuring, and which should be excluded.

The final set of claims that will be subject to the restructuring depend on a variety of factors.

Once the decision on which claims should be included in the Debt Restructuring process, the following methods and types will be used for implementation.

Face Value Reduction - A face value reduction is typically the most extreme adjustment, i.e.it provides the highest degree of relief to the Debtor. Also known as a ‘haircut’, the nominal value of outstanding debt is reduced.

Maturity Extension - Maturity extensions, also known as ‘reprofiling’, are less extreme than haircuts; they involve maintaining the original nominal value of the liability but changing the date on which the final principal payment is to be repaid. By prolonging the payment period, the debtor may gain some relief via Net Present Value Reductio (NPV) reductions (though this depends on the discount rate applied) and can help alleviate ‘bunching’ or short-term liquidity pressures.

Coupon Adjustment - Coupon adjustments provide some relief to the debtor (via NPV) reductions, but do not provide haircuts and do not change the final maturity date. Thus, they likely provide the least relief of the three options.

It is important to note that these three options are not mutually exclusive; in fact, most restructurings will use a combination of all three types to achieve the desired level of relief in the context of what is acceptable to creditors.

Most importantly, the decision of exclusion and type/s of debt restructuring to be used will be undertaken by undertaken by the mutual agreement of the creditor and the debtor.